In January, New York Gov. Kathy Hochul announced that, effective immediately, the State University of New York system was no longer withholding transcripts from students who owed outstanding balances. The move benefited thousands of students.

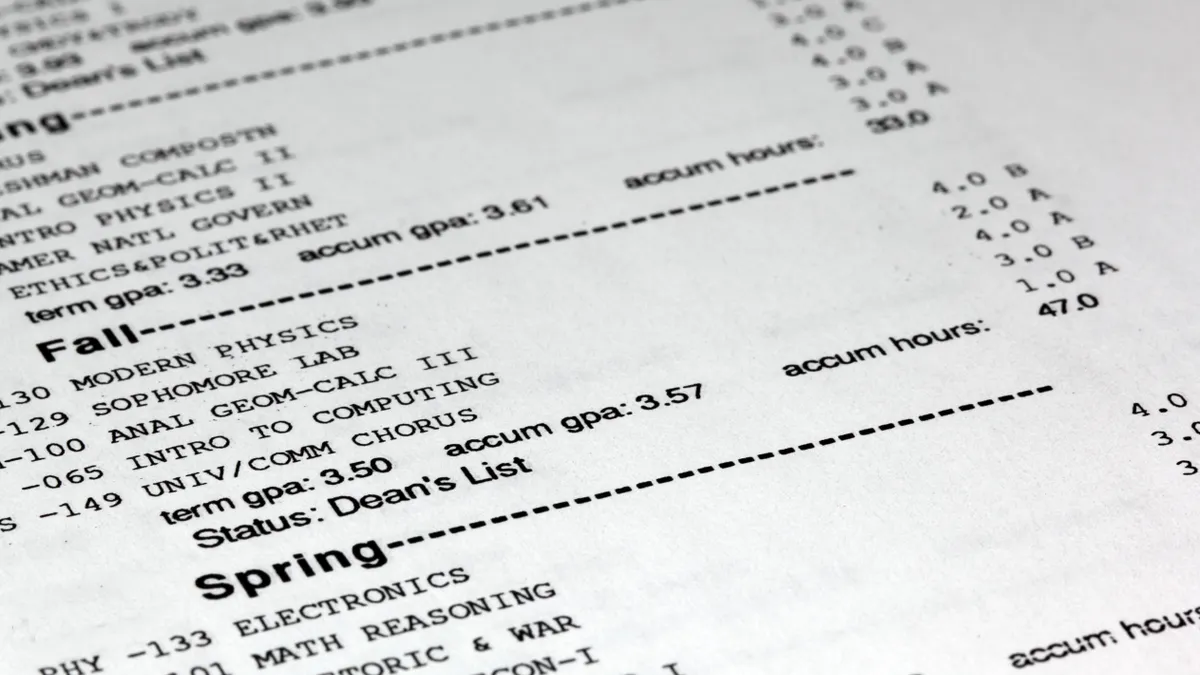

Transcript holds prevent students from receiving official copies of their academic records. If students can't afford to pay their debts, their credits become stranded and they are left with no way to formally document their previous learning for employers or other colleges where they might want to enroll.

New York is part of a wave of states and institutions enacting policies to help students regain access to stranded credits, according to a new report from Ithaka S+R, a nonprofit research firm focused on higher education.

An estimated 6.6 million students in the U.S. have stranded credits, according to 2020 Ithaka S+R research. While the federal government's guidance no longer promotes transcript withholding, the U.S. Department of Education has not released an updated directive on the subject, leaving the issue to states and institutions.

State efforts to limit transcript holds

Eight states have passed laws prohibiting or limiting the use of transcript holds: California, Colorado, Illinois, Maine, Minnesota, New York, Ohio and Washington. In one of the strictest bans, California prevents public and private colleges from withholding transcripts for students with unpaid balances.

But a ban does not address both parts of the issue — the transcript and the unpaid balance — according to Sarah Pingel, senior researcher at Ithaka S+R and author of the report.

Under laws banning transcript holds, colleges can still block students with unpaid balances from registering for classes. They can also send unresolved accounts to collections, leaving students without the ability to negotiate or create a repayment plan with colleges.

"A transcript withholding ban would let a student access their transcript, but we don't know what other practices institutions or systems could still pursue to still collect on that unpaid balance," she said. "Addressing both is key."

Some states use debt referral to get unpaid balances off of colleges' books. Four states — Louisiana, New York, Ohio and Virginia — allow or require public colleges to transfer past-due balances to state debt collection agencies.

However, the process may exacerbate the issue more than help, according to the report. Students with past-due debts are more likely to be low-income and can be hurt by state agencies' abilities to intercept tax refunds or garnish benefits like unemployment insurance.

Maryland, Minnesota, Virginia and Washington have issued legislative mandates to study the issue and release their findings publicly.

Institutions can rescue stranded credits

College-level policies can address stranded credits and help retain students at risk of stopping out. Individual institutions have added more flexibility in billing, including by reviewing a student’s balance along with their financial aid to ensure they received all the help for which they are eligible.

Institutions should increase communication and flexibility between campus units, such as the financial aid department and the enrollment office, according to the report. It also recommends colleges cooperate with nearby institutions to share transcripts and settle past-due debts.

Multiple tactics for rescuing stranded credits can be used at once. For example, Ithaka S+R facilitated a recent partnership between eight public colleges in northeastern Ohio. The colleges agreed to resolve students' outstanding institutional debts and create personalized plans to get them back in the classroom, often by helping them transfer to different colleges within the consortium.

"We've heard from a lot of places interested in starting up their own kind of version of the Ohio compact," Pingel said. "We're learning and focusing on how we scale this kind of agreement for institutions and systems with different needs."

The arrangement is based on the belief that forgoing short-term revenue from student balances can make sense if it means colleges could collect tuition revenue from learners in the future, according to Pingel.

"To my view, it would be shortsighted to focus on a $100 debt now and then not collect any future tuition revenue from that student because you removed the possibility of them finishing their credential," she said.