Dive Brief:

- Two bills proposed in Rhode Island would enable cities and towns to tax private colleges' endowments and properties.

- One piece of legislation would permit up to a 2% tax on private institutions' endowments, the proceeds of which would benefit K-12 public school districts where the colleges are located. The other bill would allow taxes to be levied on private nonprofit colleges' property, raising revenue that would flow into municipalities' general funds.

- The measures would raise the most from the state's wealthy institutions, namely Brown University, which opposes them.

Dive Insight:

Efforts to tax colleges have extended to the federal government, notably with a reform law the Trump administration spearheaded in 2017. This so-called endowment tax imposed a 1.4% excise tax on net investment income at private institutions that enroll at least 500 tuition-paying students and have assets of at least $500,000 per student.

It prompted outcry from the band of affluent institutions it affected and other higher education leaders.

Susan Whealler Johnston, president and CEO of the National Association of College and University Business Officers, wrote to the U.S. Department of the Treasury in 2019, calling the levy "an unprecedented and damaging attack on the tax-exempt status" of institutions.

Democrats proposed limiting the tax in a 2021 spending plan, but it remains unchanged and in effect.

State-level attempts to subject colleges to taxes have reached public institutions. In Pennsylvania, proposed legislation would end property tax exemptions for public colleges. It would include state-related institutions, such as Pennsylvania State University, which receive state funding but function with more autonomy than colleges in the state-owned Pennsylvania State System of Higher Education.

The bill's sponsor, Democratic Rep. Angel Cruz, wrote in a public memo that keeping colleges off the tax rolls means the financial burden of municipal services unfairly falls to individual taxpayers, even as colleges benefit from those services.

Similarly, the sponsor of the Rhode Island bill, Democrat David Morales, has argued private colleges need to pay their fair share.

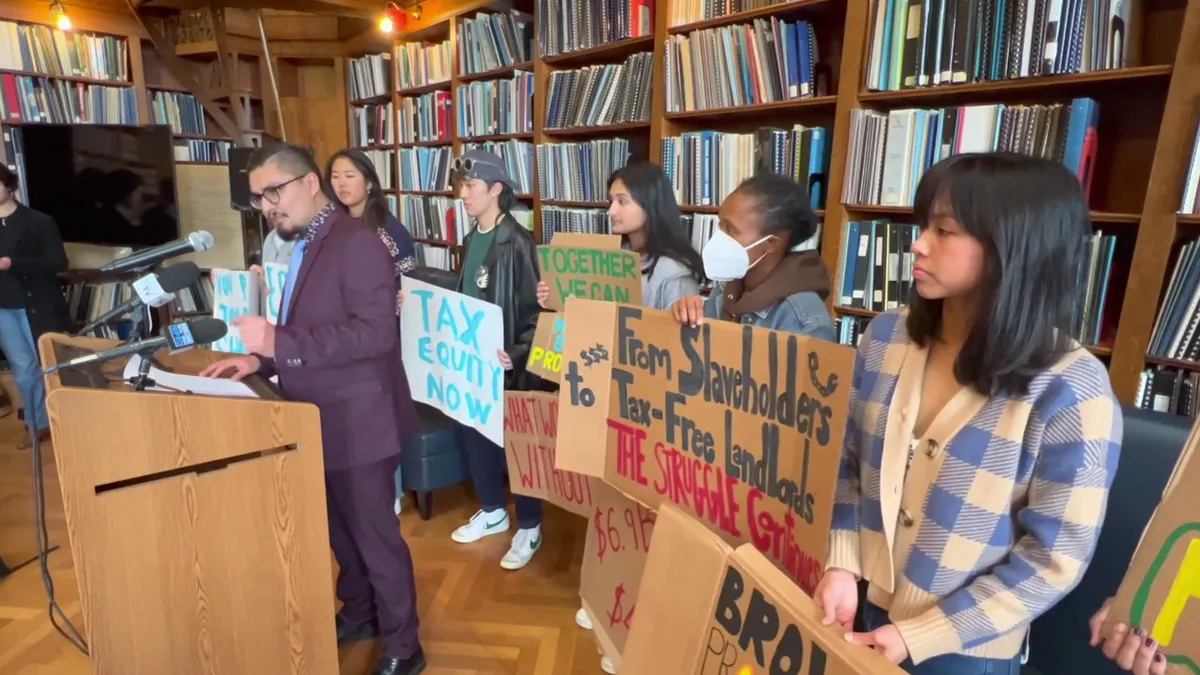

Morales did not respond to a request for comment Monday. But at a recent news conference, Morales pointed out that Brown University's endowment had ballooned to $6.9 billion at the end of fiscal 2021.

"Meanwhile, our Providence public schools remain underfunded, lack mental health resources and our facilities are left crumbling," Morales said at the event.

A 2% tax on Brown's endowment would amount to an additional $138 million for Providence.

Brown spokesperson Brian Clark said in an email that legislative efforts to tax institutions impede their ability "to help students, improve education, expand the boundaries of knowledge, advance technological innovation, and enhance health and well-being in our local communities."

Endowment money is not merely kept in reserve but increasingly used to support operations, Clark said.

Clark also said such legislation overlooks the contributions Brown provides to the surrounding community, including teacher training, tutoring and other programs in public schools and healthcare work. The institution employs 4,700 residents and injects more than $200 million in research spending into the local economy each year, Clark said.

The National Association of Independent Colleges and Universities, which represents private nonprofit institutions, also is against taxing endowments. Karin Johns, the association's director of tax policy, in an email called the practice "ill-conceived at the federal level" and said it "has created a dangerous precedent at the state level."

Private colleges rely on charitable donations, said Johns, adding that when cities and towns fail financially, "they simply can't take the money from private colleges."

"And the same goes for taxing private college property," Johns said. "Mayors need to reshuffle their budget priorities and make better funding decisions — and not look to charitable donations to private colleges to shoulder that burden."