Editor's note: Tony Collins is the president of Clarkson University, in New York. You can read Higher Ed Dive's coverage of considerations for using income-share agreements here.

We see it in the headlines on a regular basis: The salary premium of a college degree remains significant, but the costs and associated risk have never been higher. Data from the Federal Reserve Bank of New York shows the average college graduate earns around $30,000 a year more than someone with only a high school degree, but that average hides a lot of variance. And the COVID-19 crisis has magnified this difference. In times of economic downturn, college degrees are an even more important proxy for job readiness — at the exact moment they become more difficult to afford.

For families with a college-bound student, this can make the decision even more paralyzing. As the president of a private research university, we often hear from parents and prospective students asking the ultimate question: How do I know if this degree will pay off?

One answer is to ensure institutions have skin in the game. Even before the pandemic, so-called risk-sharing models, like income-share agreements, were emerging that sought to align the cost of college with student outcomes after graduation. The ISA math is simple: If a student graduates and their income meets a certain threshold, they pay more for their credential. If they do not, they pay less — no questions asked.

ISA program terms vary for each institution, and families should definitely ask questions about trade-offs from other forms of college aid. As with any student loan or payment plan, there may be scenarios where paying upfront for tuition will cost less than returning a portion of future income. Unlike other financial products, ISAs may also cost students less or nothing at all, if they are unemployed or earning below a minimum income threshold after they graduate. Payment percentages are always aligned to earnings income and the percentage is fixed.

With students and higher education institutions both looking to get a good return on the educational experience, ISAs are a straightforward way to incentivize institutions to invest more in their students' futures.

Three years ago, Clarkson University added an ISA option with the support of our alumni to help students pay for college. We front a set amount of tuition and fees in exchange for a percentage of the student's salary for a fixed number of months after they graduate or leave the school. For us, their salary must hit a minimum threshold before the agreement kicks in. If they aren't employed, or they pursue a public service assignment like the Peace Corps that supports social good, the institution isn't paid at all.

How does this approach work in practice, and can it actually help achieve our goal of helping students prepare for, and enter, stable careers — especially during a time of economic crisis?

At Clarkson, we have begun by making up to $10,000 in ISA funding available each year to 20 to 25 high-achieving freshmen in any major. We selected this amount to help close funding gaps left by traditional financing, without creating overwhelming ISA payment obligations after graduation.

The program is rooted in Clarkson's approach to admissions: We accept students based solely on their merit and demonstrated interest in building a meaningful career. This stems from an institutionwide philosophy that we should enroll not just students, but future alumni. We are proud to have a federal student loan default rate well below the national average — just 2.2% compared with nearly 10% — but we felt we could better share risk with our students. The goal of the ISA has been to ensure Clarkson graduates could weather times of economic crisis. Of course, we could never have imagined a crisis of this magnitude.

Family background — such as parents' credit history — can negatively impact a student's ability to get a loan, and by extension, their ability to attend school at all. Clarkson's ISA program is designed to address that issue by reducing financial barriers for our students while setting them up for career success. Students with access to traditional financing may supplement loans with an ISA. Students with limited access to loans may find ISAs helpful, too.

As we scale up our ISA funding to support more students and create a new paradigm for financing, we are already seeing the impact and learning important lessons. Students who participate in our ISA program mirror the overall Clarkson student body demographics in terms of gender, racial and ethnic diversity, and academic preparation. They are high achievers, with median GPAs of 3.8 and SAT scores of 1300. And they are pursuing a range of career opportunities across engineering, business and science.

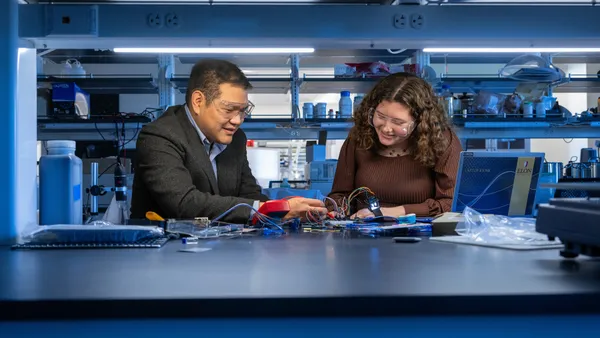

Not only that, but the intensified career advising we provide as part of the ISA program, which focuses on career exploration and leadership skills, has been well received by students thus far. The ISA program provides students with an active and coordinated career advising strategy, including a career center staff member who monitors each student's progress toward certain milestones, like finding internships or participating in events with alumni and corporations. They also work with students one-on-one to ensure they are developing the skills and experiences desired for post-graduation success. Ultimately, Clarkson is investing in students' career outcomes, and it is in both our interests that they succeed.

Although ISAs hold the potential to redistribute risk, questions are rightfully mounting about their efficacy for students and their long-term viability for institutions. Some critics suggest existing loan regulations could cover ISAs. Others argue such regulations would leave room for bad actors to exploit the unique terms of ISAs, such as the income share percentage and maximum payment term.

Indeed, a well-developed regulatory framework that accounts for the unique features of ISAs will be critical to their success. So, too, will continued iteration on the ISA model, built on the experience of early adopters.

We have an even greater incentive to invest in thoughtful career and life counseling that gets students to graduation — at a time when those outcomes have never been more important.