Dive Brief:

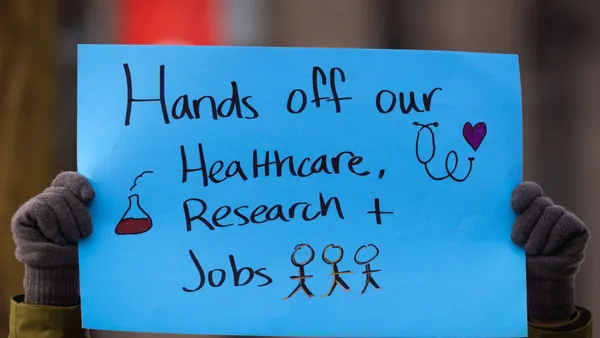

- Three-quarters of surveyed federal student loan borrowers who were making regular payments before the pandemic prompted the federal government to freeze payments and interest accumulation expect to be able to resume payments after the pause ends, according to a new report from the Federal Reserve Bank of Philadelphia.

- Meanwhile, over one-fifth of surveyed borrowers with federal student loans are chronically struggling, meaning they didn't make payments in 2019 and don't expect to do so when the freeze ends. The authors say these borrowers would benefit from more comprehensive solutions than a temporary pause in payments, called a forbearance.

- The report's authors conclude that further blanket forbearance extensions are costly and benefit borrowers who don't expect to struggle with their payments. For borrowers who expect to struggle, the extensions mostly don't appear to be helping them to take steps that could free up future cash flow for student loan payments, like building up savings or paying off other debts.

Dive Insight:

Roughly 42 million borrowers are covered by a federal student loan repayment pause that began in March 2020 because of the coronavirus pandemic. While the freeze was meant to offer relief to those with student loan debt, the Philadelphia Fed's report concludes that it is largely benefiting a group of borrowers who say they could make their payments — and doesn't go far enough to address some of the issues that other borrowers face.

"For some borrowers, additional forbearance extensions are simply postponing a day of reckoning with loan payments that are unaffordable," the authors wrote.

The Philadelphia Fed reached its findings after studying a national sample of 13,423 consumers in January and April of this year. It focused on respondents aged 25 and older.

Adult student loan borrowers aren't a group college and university leaders frequently consider a top priority. But their situation is a major higher ed policy consideration at the moment, and their experiences could color public perception of higher ed, which is a key concern for college leaders.

Last month, the Biden administration extended the federal pause until the end of August. At the time, Education Secretary Miguel Cardona said the extension would give borrowers more time to gain financial security as the economy recovers from the pandemic.

The forbearance period was expected to give borrowers a chance to shore up their savings or pay off debts, according to the report. But the Philadelphia Fed's survey found only a slim share of borrowers were taking those routes.

Of borrowers who expect to make full or partial payments once forbearance ends, only 17% to 30% are either building savings or paying off debts. Those shares shrink for borrowers who don't expect to make payments after the freeze ends. Just 10% of them are paying off debts, while less than 5% are building up their savings.

Meanwhile, 45.7% of borrowers who didn't complete their degrees don't expect to make payments once forbearance ends. That share rises to 82.1% for borrowers who are working in occupations different from their degree fields.

"Taken together, these survey responses suggest that continued, chronic repayment struggles are primarily the result of education debt that did not lead to income and employment outcomes to support that debt," the report's authors wrote. "This appears to be more important, in most cases, than the transitory labor market and income shocks that occurred during the pandemic."

The Biden administration has been weighing plans to cancel some student loan debt, such as by targeting borrowers who make less than $125,000 annually, Politico reported.

Most people with education debt preferred that student loan cancellation be targeted rather than applied to all borrowers, with 28.4% in favor of based it on income, according to the Philadelphia Fed. Similar shares of borrowers, around 17% each, preferred that cancellation be based on a borrowers' assets or education debt.