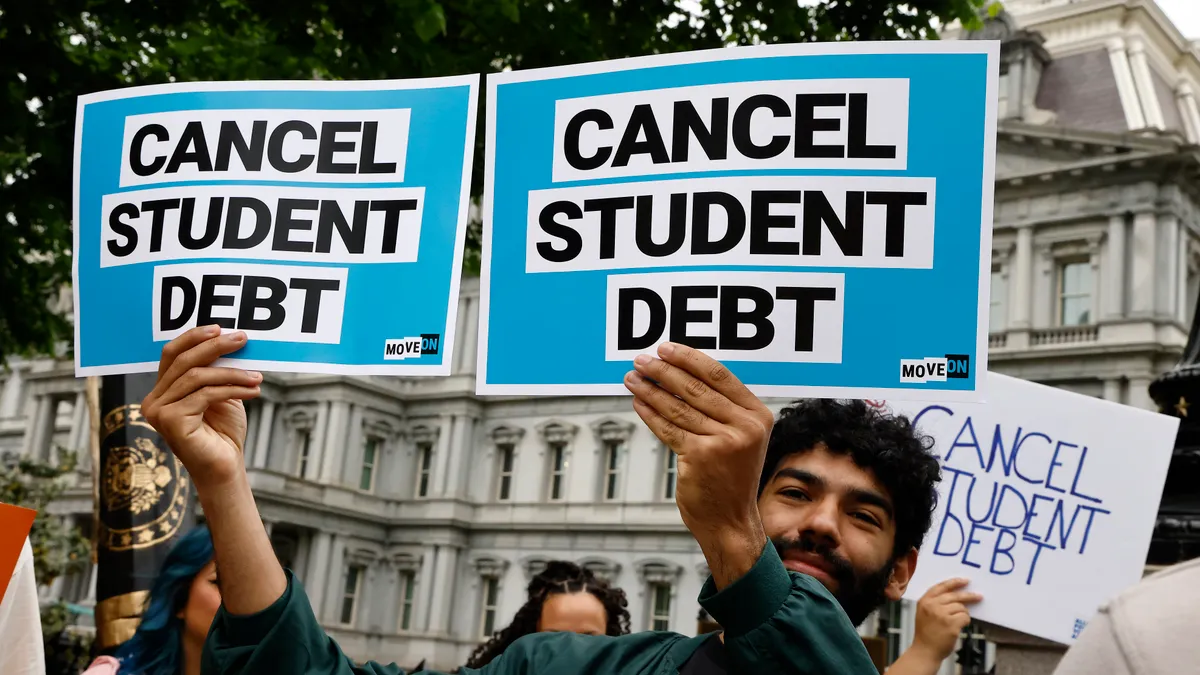

Higher education leaders largely supported the Biden administration's Wednesday announcement that it would cancel $10,000 in student loan debt for individuals making less than $125,000 annually or couples filing taxes jointly making under $250,000.

In the same breath, many leaders qualified the move as a good starting point — but not a long-term solution to the ballooning cost of college and high-balance loans.

The forgiveness — which eliminates an additional $10,000 of debt for borrowers who received Pell grants in college, for a total of $20,000 of relief — fulfills one of President Joe Biden’s campaign trail proposals. Biden also extended the pause on federal student loan payments for a final time through the end of 2022.

As current and former students evaluate how the policy affects their finances, higher education membership associations and advocacy groups released statements lauding the news and calling for further actions.

A step in the right direction

Kim Cook, CEO of the National College Attainment Network, a nonprofit focused on student success, praised the plan's broad-based action but argued the core issue of the country's student loan debt still must be tackled.

"We need to address the root cause of the college affordability crisis so that future generations do not confront the same challenges that have brought us to today," Cook said. "Fast rising and unmanageable levels of student debt are the result of a broken system for financing higher education in which many parents and students are forced to take out loans they cannot reasonably be expected to repay."

Cook pushed for the administration to expand income-based repayment options for students, and to bring down the net cost of education through public investment in financial aid and institutional support.

Similarly, Maria Flynn, CEO and president of Jobs for the Future, a workforce-focused nonprofit, supported Biden's action but listed specific actions her organization believes the government should take next.

Flynn wants Biden and Congress to strengthen and simplify the federal income-driven repayment process, fund college completion efforts, invest in navigational support for students, and explore financing approaches that align college financial incentives with student economic outcomes.

Her organization also pushed for the reinstatement of the gainful employment rule, a previous Education Department regulation used to measure if colleges were producing graduates who earned enough to pay off their loans. The Education Department plans to release a new gainful employment proposal next year.

"Without these structural reforms, longstanding problems such as low completion rates, poor-quality credentials, and students taking on unnecessary debt will remain unaddressed, potentially leading to an even bigger debt crisis in the near future," Flynn said in a statement.

Without such reforms, the current systemic issues will go unchecked and potentially lead to an even bigger debt crisis in the near future, Flynn said.

In a statement, Peter McPherson, president of the Association of Public and Land-grant Universities, made it clear the APLU expects the federal government to take further action to improve college affordability.

"Decades of disinvestment has left students shouldering an increasing share of the cost of college despite vast societal benefits of a college-educated workforce and citizenry," McPherson said. "Moving forward, it’s essential that Congress and the Biden administration work together to also invest in programs to make college more affordable and, in turn, limit student debt from accruing in the first place."

McPherson called on Congress to create targeted measures to hold accountable colleges that fail to provide strong student outcomes.

Putting the plan into action

Higher education leaders also stressed that the debt-forgiveness rollout should be well-organized. Previous government programs designed to alleviate student debt burden have been plagued by poor communication and mismanagement.

Biden's loan forgiveness program will allow many borrowers to imagine a better life and a future with savings and a positive net worth, instead of being perpetually indebted to the government — but only if it's implemented correctly, argued Abby Shafroth, director of the Student Loan Borrower Assistance Project at the National Consumer Law Center.

“The government must deliver by making sure that all eligible borrowers, and particularly the most vulnerable, get the relief they have been promised. Relief should be automatic, without requiring people to jump through hoops," Shafroth said in a statement. "

Mike Pierce, executive director of the Student Borrower Protection Center, a nonprofit focused on alleviating student debt, said the Biden administration must ensure that no students eligible for loan forgiveness will have to make payments when the moratorium ends in January.

“For decades, our government has made big promises to people with student debt but repeatedly failed to deliver," Pierce said in a statement. "This means that the student loan system must remain shut off until the President keeps his promise to every single American with student debt."

In a statement, Justin Draeger, president of the National Association of Student Financial Aid Administrators, said the plan prioritizes borrowers who struggled to afford higher education the most.

Nearly 90% of the relief dollars will go to those earning less than $75,000 a year, according to the White House.

However, Draeger cautioned that the plan must be rolled out judiciously to actually target relief to low- and middle-income borrowers.

"We urge the Department to carefully consider how this relief can be implemented as easily as possible, while still ensuring commonsense safeguards to ensure the right people get the right benefits," he said.

Draeger also criticized how long the Biden administration waited to extend the federal student loan moratorium, which had been set to expire on Aug 31. He called on the Education Department to develop an “on-ramp to repayment.”

"The timing of this announcement creates counseling challenges for financial aid offices, who do not have the information they need to adequately advise students in a timely way," Draeger said. "After more than two years without student loan payments, transitioning millions of borrowers back into repayment cannot happen at the drop of a hat.”

A widespread call for Pell increases

The loan cancellation comes shortly after the Biden administration has increased federal investment into higher education. In March, Biden signed a spending package increasing the maximum Pell Grant for the 2022-23 school year by $400, the biggest increase since the 2009-10 school year, according to NCAN.

Many in the higher education sector now want Biden to fulfill another talking point from his campaign — doubling the maximum value of Pell grants. Draeger, McPherson and Cook all supported a dramatic increase in investments in the Pell Grant program.

Draeger pointed to the high cost of Wednesday’s announcement. Canceling $10,000 for borrowers earning less than $125,000 a year would cost the government an estimated $329.1 billion over 10 years, according to the Penn Wharton Budget Model.

"If even a fraction of the amount being spent on debt forgiveness were spent on upfront grants like Pell, many low- and middle-income students would borrow much less," Draeger said.