High schools are getting an early start on helping this year's 12th graders fill out the Free Application for Federal Student Aid, given the delays and technical difficulties experienced with the federal form last school year.

FAFSA completions for the class for 2024 fell by nearly 9% compared to the graduating class the year before, according to a National College Attainment Network tracker updated Nov. 1. The application helps students obtain federal financial aid, scholarships and tuition aid packages from colleges.

Last year, the release of an updated and streamlined application form was delayed by several months, and technical glitches hampered many students' ability to complete the form when it did become available. Researchers found first-year college enrollment declined most severely at four-year colleges that serve high populations of Pell Grant students, who typically must show exceptional financial need to obtain those awards.

This year, the U.S. Department of Education, which oversees the FAFSA program, made the form available to a limited number of users on Oct. 1. It should fully launch starting Dec. 1 or earlier.

The Education Department is required to make the form available to everyone starting around Oct. 1 and no later than Jan.1. A bill in the House proposes amending the Higher Education Act to require that the form be released no later than Oct. 1 prior to the applicant's planned year of college enrollment. The legislation, which the House passed last week, would require the education secretary to testify to Congress if the agency anticipated missing the deadline.

To help students have a smoother experience this year, here are three actions schools are taking:

Encouraging students to create an account

Even before the form is available to students, they can start the process by creating their accounts on StudentAid.gov to apply for, receive and manage their federal student aid.

This step to create an account can save time once the application becomes available, because even though the Education Department says that step only takes about 10 minutes to complete, information such as a Social Security Number is required. If students don't have that or other required information, they will need to get those.

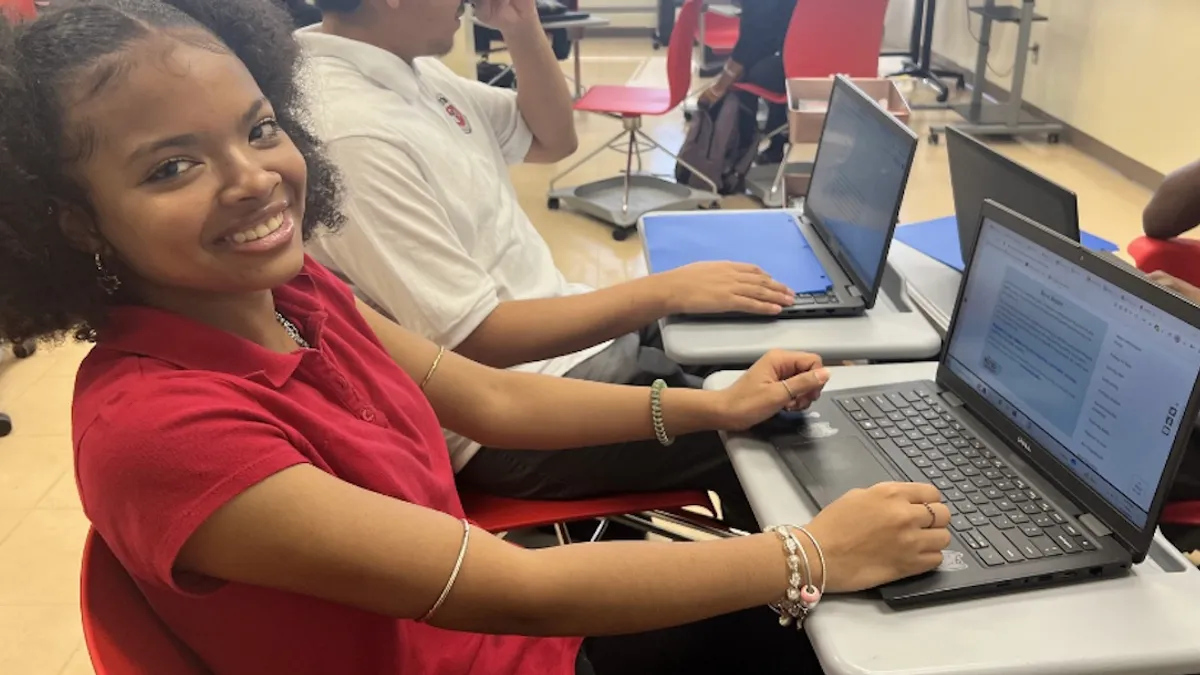

At Queen City Academy's summer orientation, staff at the New Jersey public charter school recommended that rising 12th graders create their FAFSA accounts, said Danielle West-Augustin, the school's chief academic officer and director.

The class of 2025 is the school's first graduating class, and many of them will be the first in their families to attend college. About 20% of the 12th graders are on track to earn both their high school diploma and associate degree. The K-12 school aims to eventually graduate 100% of students with both a high school diploma and college credits through dual enrollment.

The FAFSA is an important step in the college admissions process, because it's "what puts your financial picture together, or what you're going to need to pay and how you're going to pay for school," said West-Augustin, who is also board president of the New Jersey Public Charter Schools Association.

Although the 2025-26 FAFSA deadline is June 30, 2026, states and colleges may have different deadlines students should also be aware of, college access experts said.

Teaching about financial pathways to college

During the Queen City Academy summer orientation, school staff gave parents a heads up about what types of financial forms would be required for the FAFSA, West-Augustin said.

The school also includes postsecondary financial awareness in its high school financial literacy course, which is state-required, said Principal Ernest Dixon. Topics in the course include college expenses, student financial aid and student debt.

Parents and students should have conversations about opportunities for college affordability early in the college application process, said Aly Murray, founder and executive director of Upchieve, a nonprofit that provides free online college counseling and academic support to Title I schools. Upchieve has 70,000 student users and 30,000 volunteer college counselors and tutors.

"The form's complexity is not the reason, I think, that most students — especially low-income students — aren't filling it out. It's more about the stress."

Aly Murray

Upchieve founder and executive director

Murray said one of the biggest barriers to college access for students is their assumption that they won't be able to afford to attend. "There's always a pathway to being able to afford college," Murray said.

But in addition to understanding financial aid programs, students need holistic college application coaching and emotional support during their 12th grade year, she said. There's a lot in play for 12th graders, including writing college essays, researching colleges and taking college placement tests.

"The form's complexity is not the reason, I think, that most students — especially low-income students — aren't filling it out," Murray said. "It's more about the stress."

Hosting FAFSA workshops

Queen City Academy is hosting mandatory, small-group FAFSA workshops this month and next where students and families can get help with starting and filling out the FAFSA from the school counselor, dean of climate and culture, and the principal. Earlier this year, legislation in New Jersey made it a graduation requirement for all students to complete the FAFSA or the New Jersey Alternative Financial Aid Application.

Dixon said students will receive individual FAFSA support when needed.

"We know a lot of our families just don't know" about the FAFSA process, West-Augustin said. "You don't know what you don't know, and if you've never walked through that experience before, you really do need someone to hold your hand."

Even something as simple as checking for confirmation that an application was submitted can be a valuable tip to those who haven't gone through the process before, said Murray.

At Queen City Academy, the FAFSA support is just one of the activities that the school provides for its 12th graders. The school also offers free SAT tutoring in addition to early college access through dual enrollment.

But the financial piece is critical, West-Augustin said. "So we're walking our parents through each one of those steps so that we don't get to March and, yeah, you get accepted to this great school. But guess what? You don't have the financial aid package, and you didn't have your FAFSA in play, right? So you're already behind again, and scholarship dollars are gone.”