Dive Brief:

- Trump-era changes to the U.S. tax code reduced the number of individuals donating to colleges, as well as the size of those individual donations, according to peer-reviewed research published in the Journal of Higher Education Policy and Management.

- The Tax Cuts and Jobs Act of 2017 nearly doubled the standard deduction, meaning that middle income taxpayers are less likely to see tax benefits from charitable giving.

- The change is likely to put pressure on institutions to raise tuition, said Jin Lee, co-author of the research and professor of educational foundations and leadership at University of Louisiana at Lafayette.

Dive Insight:

The overall effect on the number of individual donors and revenue from small donations is not very large, but enough to create an impact that accumulates over time, Lee said.

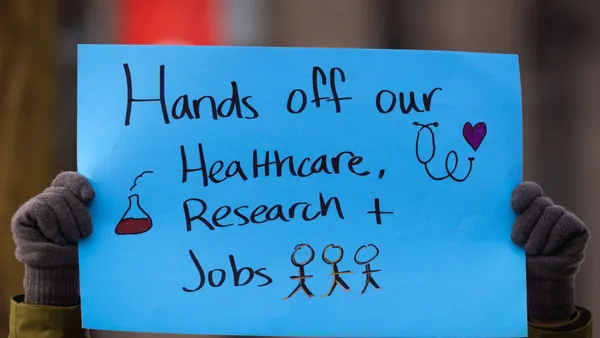

Big philanthropic donations to endowment funds or specific facilities only go to a small section of colleges and universities. Individual donations will still be necessary to continue to upgrade STEM programs and facilities, which has been of interest to the federal government, Lee said.

Considering many colleges rely on donations from individuals, “this small or moderate change in individual donations definitely affects the future funding and investment in STEM education and is definitely a driver of increased student tuition,” Lee said.

Researchers used data from 660 colleges that participated in the Voluntary Support of Education Survey between the 2010-11 and 2019-20 academic years. Private research universities saw the most significant impacts to their number of donors.

Total charitable giving did not decrease after the changes to the tax code, as high-income taxpayers continued to see tax benefits from donations and in fact donated at higher levels.

For high-income donors, charitable giving typically increases when the market is high — as it has been since 2021 — because they then have more disposable income. But this relationship is often reversed for middle-income donors, Lee said, as they can see high returns by investing in the market.

“Colleges and universities should probably change their own funding resources,” Lee said. That may mean increasing tuition or expanding legacy admissions, which could stymie opportunities for low-income students to pursue higher education.

“It definitely influences students’ access to college in the future,” Lee said.

Disclosure: The Journal of Higher Education Policy and Management and Higher Ed Dive are both owned by Informa. The Journal of Higher Education Policy and Management has no influence over Higher Ed's coverage.