Dive Brief:

- Monthly student loan repayments would be cut in half for borrowers whose installments are based on their income, under a regulatory plan the U.S. Department of Education unveiled Tuesday.

- Currently, many borrowers enrolled in an income-driven repayment plan must shell out 10% of what the Education Department considers discretionary income every month. Its newly proposed rule would change that so borrowers would pay only 5% of that income monthly. Further, the draft regulation would broaden the number of single borrowers with lower salaries who wouldn’t have to pay anything — until they earned $30,500 or more a year.

- The Education Department also said Tuesday it intends to construct and publish a list of “low-financial-value” college programs. The department is asking for feedback in the next 30 days on factors it should use to create the list and said the education secretary later this year will request improvement plans from institutions on it.

Dive Insight:

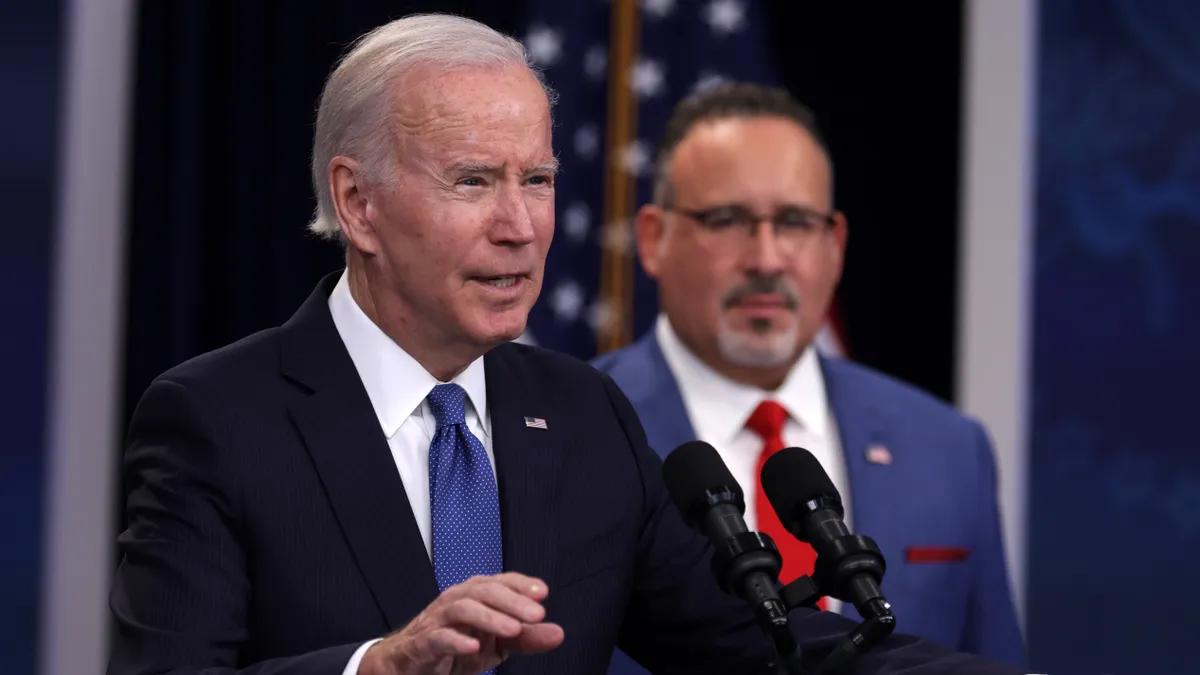

The proposed reworking of income-driven repayment plans, commonly known as IDR, fits with the Biden administration’s stated mission to overhaul the beleaguered federal student loan system and enact new borrower protections.

Policymakers of all political stripes have called out flaws with federal loan options after the number of students taking out debt soared and many faltered in repaying it. The student loan portfolio has swelled to more than $1.7 trillion, in large part due to rising college costs.

However, Republicans have come out strong against the White House’s most notable initiative — its attempt to cancel broad amounts of student debt for borrowers earning up to $125,000 a year. Court rulings stalled that plan, as critics who sued argued the administration had overstepped its executive authority. The U.S. Supreme Court is due to hear oral arguments in the loan forgiveness cases in February.

Potential changes to IDR represent the debt-related initiative Education Secretary Miguel Cardona is most proud of, he said in a call with reporters Monday night. He said he views the rebuilding of IDR as something that could open opportunities for future disadvantaged students to not be saddled with ruinous amounts of debt.

“This is a promise we will fix a broken system,” Cardona said.

The department plans to finalize the rule this year, though a senior department official on Monday could not say exactly when.

The draft regulation, which the Education Department is accepting feedback on over the next 30 days, would allow many low- and moderate-income IDR borrowers to keep more of their discretionary income.

However, borrowers who took out money for graduate school would still need to pay 10% of that income monthly. Those with both undergraduate and graduate school debt would pay 5% to 10%, based on a weighted average calculated from their original loan balances.

Those with any direct loan from the federal government would be eligible to enter this plan, except for those with Parent PLUS Loans, which families take out on behalf of their undergraduate students. Parent PLUS Loans are legally excluded from IDR plans.

The proposed rule also addresses a major complaint that student loan interest can capsize borrowers’ finances. That’s because sometimes borrowers’ monthly payments are lower than accruing interest, meaning their loan balances grow even though they're making payments on time.

The plan would stop unpaid interest from accumulating.

It would also create a 10-year timetable for borrowers with $12,000 or less in debt to pay it off, compared to the current timeframe for IDR plans of up to 25 years.

Every additional $1,000 borrowed above $12,000 would add one year of monthly payments to the required repayment time.

And the proposal would newly give IDR borrowers credit toward loan forgiveness if they deferred or went into forbearance on loans during certain periods of hardship. Such periods would include cancer treatments or military service.

Other IDR plans would be phased out. Currently, 8 million borrowers are enrolled in some type of IDR plan, according to a senior Education Department official.

The Biden administration in July delayed the release of an IDR rule. At the time, it was under fresh scrutiny as the U.S. Government Accountability Office, a congressional watchdog, found last year the department only greenlit 157 loans for forgiveness under IDR as of June 1, 2021.

Another 7,700 loans worth about $49 million in outstanding debt might have qualified for cancellation, the GAO said in a report.