Dive Brief:

- The U.S. Department of Education on Tuesday kicked off President Joe Biden’s second attempt at canceling massive amounts of student loan debt, though the new process will take months and potentially years.

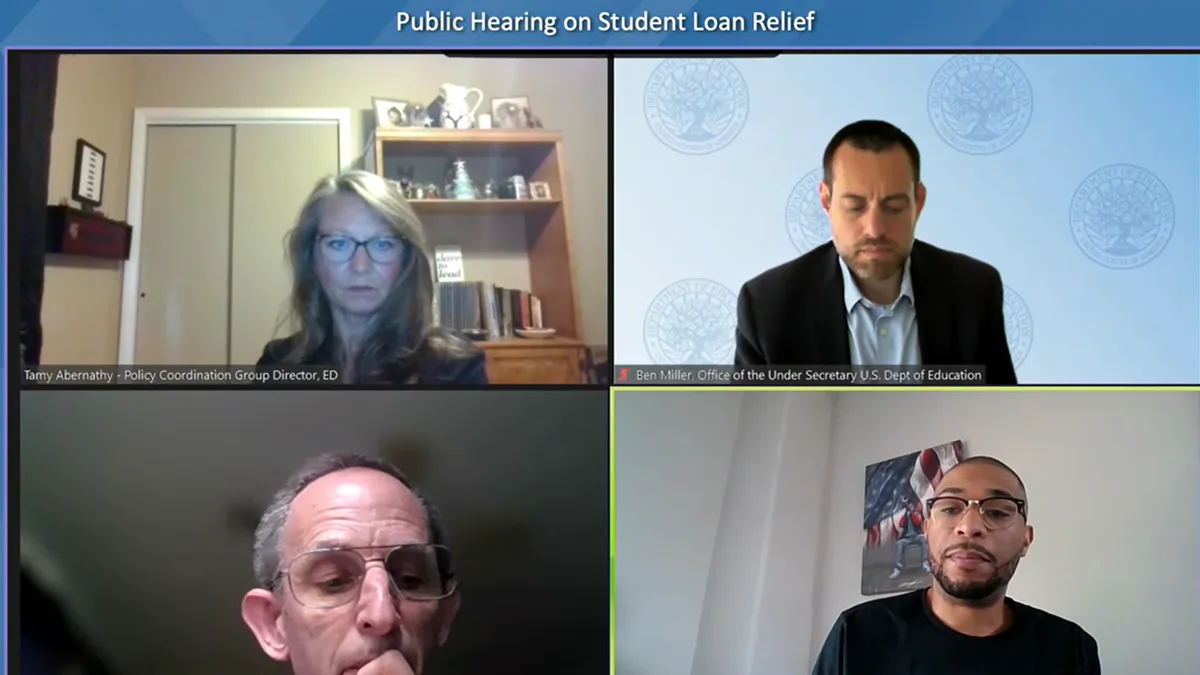

- Education Department officials hosted a virtual hearing Tuesday, the start of complex regulatory procedures the Biden administration will use to try to wipe away student loans. The inaugural session gave pundits and members of the public, both in favor of and against cancellation, a chance to air their thoughts.

- The White House is building a regulation through the Higher Education Act, the main vehicle for federal postsecondary ed policy and a different law than the one it used to justify cancellation in the first forgiveness plan that the U.S. Supreme Court struck down last month.

Dive Insight:

Biden took immediate action after the Supreme Court ruled against his initial loan forgiveness plan, which would have forgiven up to $20,000 for borrowers earning less than $125,000 a year. The same day the high court handed down its decision, Biden said he would pursue a regulation to cancel loan debt.

The Education Department now is embarking on that plan, which starts with a process called negotiated rulemaking.

Neg reg, as it's known, brings various parties to the table that would be affected by regulatory change — in this case, they’ll discuss Title IV financial aid programs.

But that can take quite a while, partially because those parties, whom the Education Department names, have to unanimously agree on policy decisions. If they do not, the Education Department can in essence take over and write a draft regulation as it sees fit.

The agency will also need to incorporate written comments from the public, which are already pouring in. As of Tuesday afternoon, more than 12,700 had been submitted since the department posted a notice to establish the negotiated rulemaking committee on July 6.

Tuesday’s hearing gave another avenue for higher ed leaders, organizations and the public to weigh in. Several speakers were individual loan borrowers, who told stories of how they viewed higher education as the ladder to social mobility but were crushed with debt.

The hearing stretched most of the day and opened with remarks from James Kvaal, the Education Department’s top higher ed official. Kvaal pledged that the Biden administration is “committed to using every tool we have” to secure loan forgiveness. To that end, he noted the hearing was happening less than a month after the Supreme Court rendered its verdict, suggesting the administration wants to move quickly.

The first public speaker of the day was Mark Chenoweth, president and general counsel of the New Civil Liberties Alliance, which describes itself as a legal group aiming to protect constitutional freedoms and root out executive overreach.

NCLA supported the lawsuit against Biden’s initial loan plan that reached the Supreme Court.

Chenoweth said any loan forgiveness plan lacking congressional authorization would face a similar fate as Biden's original version.

“It’s pulling a woolly mammoth out of a policy mousehole,” Chenoweth said.

Policy experts have also said a loan forgiveness proposal assuredly will face lawsuits.

Others who spoke at the hearing backed loan cancellation and called for other policy action.

Mike Pierce, executive director and co-founder of advocacy group Student Borrower Protection Center, said the Education Department should focus on protecting borrowers as their monthly payments resume. These had been on pause since the early days of the COVID-19 pandemic, but now will restart in October.

The Education Department should “hold harmless” those borrowers who can’t pay, Pierce said.

The agency is in effect doing this, at least for a while. Biden announced last month that until the end of September 2024, borrowers won’t be sent to collection if they don’t pay, though their interest will still accrue.

Rep. Maxwell Frost, a first-term progressive Democrat from Florida, appeared to support loan forgiveness and called it an issue of racial and economic justice.

“Forty million borrowers were promised this relief,” Frost said, referencing how many people the administration expected the original loan forgiveness plan to benefit.

That plan drew on a federal law called the Heroes Act, which allows the education secretary to unilaterally alter the federal loan forgiveness program in times of emergency.

The administration argued the COVID-19 pandemic counted as such a crisis. But the Supreme Court said Biden had overstepped the bounds of his executive power.