Dive Brief:

- The U.S. Department of Education announced Friday it is canceling federal loans and restoring Pell Grant eligibility for students who attended the Art Institute of Colorado and the Illinois Institute of Art from Jan. 20 to Dec. 31, 2018. It expects to cancel about 4,000 loans for more than 1,500 borrowers.

- The department is also extending the period of eligibility for closed-school loan discharges to June 29, 2018, for students who attended 24 other schools run by the nonprofit Dream Center Education Holdings (DCEH) that closed in December 2018.

- The news comes amid a lawsuit from former students at the two schools. They asked the court to void loans made to students at the institutions from Jan. 20, 2018, through their closures in December of that year.

Dive Insight:

The students allege the department continued to provide the schools with Title IV funding even though they weren't accredited during the 2018 spring semester. Documents released by the House's education committee last month offered more evidence to support those allegations, The Washington Post reported.

The accreditation issues at the two campuses stem from the complex and ill-fated sale of a set of Art Institutes and two other college chains in the fall of 2017 to the Dream Center Foundation, a faith-based nonprofit with no prior higher education management experience. The foundation set up DCEH to manage the schools.

As a result of the ownership change, the two Art Institutes' accreditor, the Higher Learning Commission (HLC), downgraded their status, making them ineligible for Title IV funding as of Jan. 20, 2018.

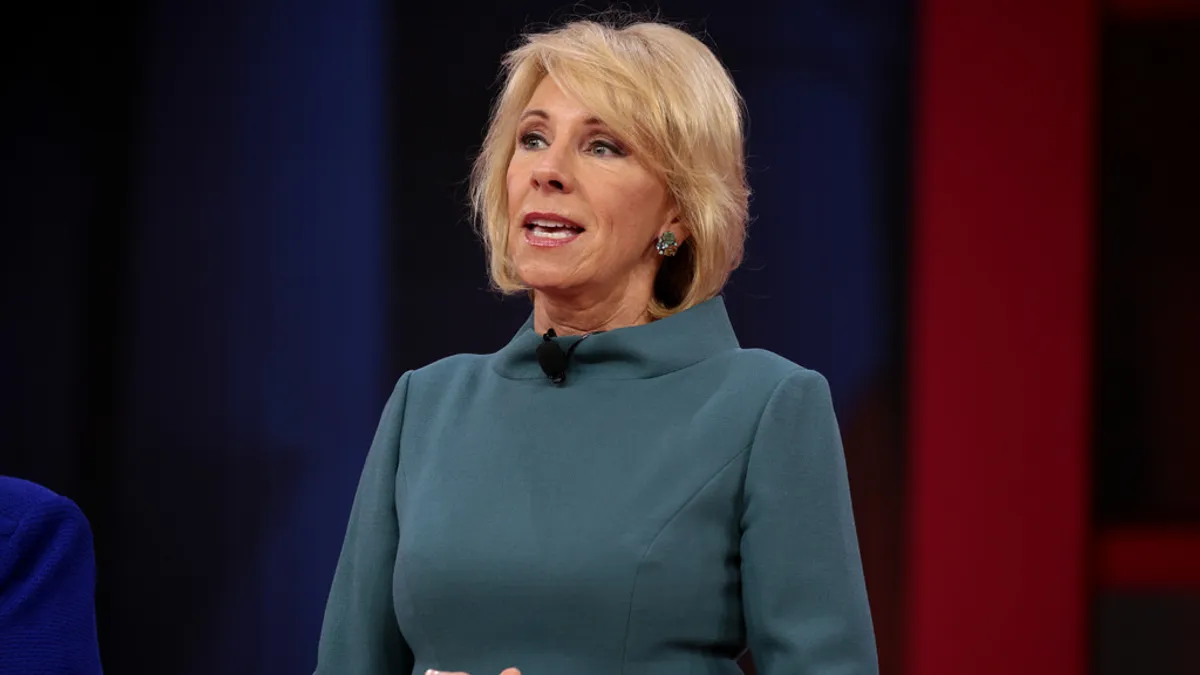

The department was aware that DCEH, which has since shut down, was advertising two unaccredited campuses as being accredited, according to a July 16 letter from a House committee to Education Secretary Betsy DeVos. The department continued to fund the schools, the committee alleged in the letter, saying it would retroactively accredit them, and did not inform Congress.

Lawyers for the students say this meant students weren't aware they were taking out loans or making tuition payments to attend an unaccredited college.

In its statement Friday, the department said the students "were harmed" because HLC changed the two school's classifications to "a newly developed and improperly defined" status and required them to note the accreditation lapse on students' transcripts.

HLC "applauds" the decision, it said in a statement emailed to Education Dive on Friday. However, it noted that "the institutions did not appropriately inform their students" of the accreditation change as it "required and specifically instructed," and that it had notified the department of the new status. HLC also said the policy in question "was not new" and had been in place since 2009.

Aaron Ament, president of the National Student Legal Defense Network (NSLDN), which represents the students, told reporters on a call Friday that the ruling was a "major victory" for the students at former Dream Center schools. "We are really thrilled for them that they will get their loans discharged and be able to move on with their lives," he said.

But NSLDN told reporters that, for now, they are not dismissing the lawsuit against the department.

The department expects extending the period of eligibility for closed-school loan discharges will help some 300 additional borrowers. Typically only students who withdrew 120 days or less before their school closed can have their loans forgiven.