Dive Brief:

- The U.S. Department of Education in court filings Friday denied Grand Canyon University's assertions that the agency wrongly refused the school's request to change from for-profit to nonprofit status for the purpose of receiving federal student aid.

- Among Grand Canyon's claims in a lawsuit filed earlier this year was that the department had a history of basing its decisions about tax status changes on those of the Internal Revenue Service, which approved the university's request.

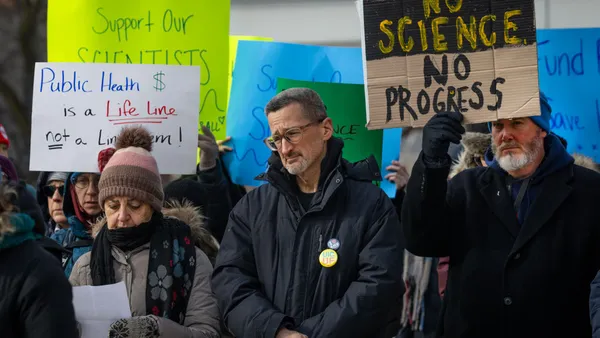

- The response comes as Democratic lawmakers show increased interest in the department's scrutiny of for-profit college conversions.

Dive Insight:

The department pushed back on a host of allegations from Grand Canyon about how it handled the school's request to become a nonprofit institution.

Grand Canyon argued that the department exceeded its authority by not following the IRS's conclusion. It also said the agency went beyond its scope by questioning whether the university could have procured services it is now getting from its parent company from multiple providers or at a better price. And it alleged the department treated Grand Canyon differently from other institutions seeking to make a similar change.

The university split from its former parent company of the same name in mid-2018. It retained that firm as a services provider in exchange for a cut of tuition revenue. As part of the separation, the university sought to become a nonprofit college. The IRS approved the decision, but the department did not.

Court filings show the department and university continued conversations about a potential status change following the agency's rejection of the request in late 2019, with the university altering some aspects of its relationship with its former parent in response to the department's concerns.

Now, Grand Canyon is turning to the courts. In its lawsuit filed Feb. 2, the university called the department's decision to keep it a for-profit "arbitrary and capricious" and lacking "fundamental fairness."

The legal challenge is playing out as Democratic lawmakers take a renewed interest in how the department handles these transactions.

Legislation proposed last week would expand the Higher Education Act's oversight of the process by which for-profit colleges convert to nonprofit status. Its provisions include requiring transitioning schools to be subject to regulations for proprietary colleges for at least five years and setting up an office within the department to oversee these transactions.

A report from the U.S. Government Accountability Office released earlier this year highlighted concerns with how the IRS and department process the conversions. It advised the department to monitor the audited financial statements of all newly converted nonprofit colleges to determine whether there's a risk of insiders benefiting improperly.

The GAO found the potential for unfair insider benefit in two of the three cases it reviewed in depth, according to the report.