Dive Brief:

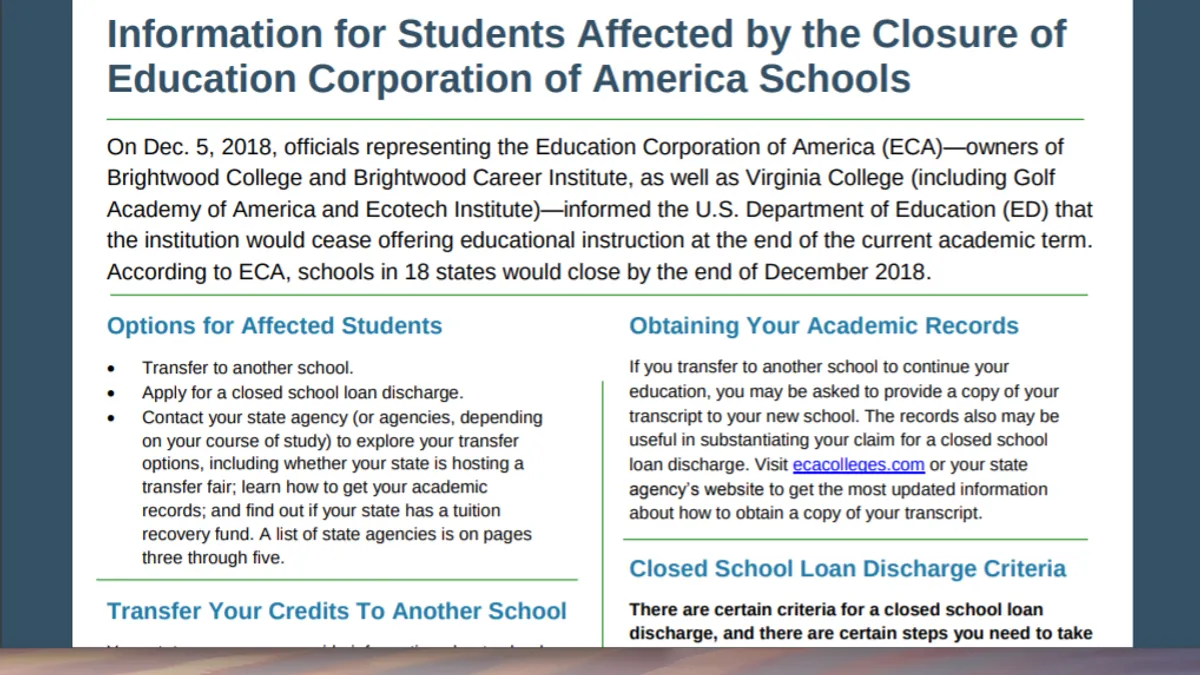

- The U.S. Department of Education has begun providing information to some 20,000 students displaced by the sudden closure of most campuses under the for-profit college operator Education Corporation of America (ECA). Affected students can transfer to another school, apply for a loan discharge or contact their local state education agencies for more options.

- ECA, which operated Virginia College and Brightwood Career Institute, now lists on its website partnering colleges by state for transfer students. They include locations of the for-profit Fortis Colleges and Institutes, the for-profit Lincoln College of Technology and Remington College (once a for-profit, now designated as a nonprofit), among several other institutions.

- ECA informed the Ed Department on Dec. 5 that it would end instruction at its campuses by the close of the current academic term. The abrupt shutdown prompted some employees to sue ECA over alleged violations of the Worker Adjustment and Retraining Notification (WARN) Act.

Dive Insight:

Although the company was under financial distress for some time, ECA's shutdown came with little warning to the Ed Department and prompted a sharp rebuke over the abrupt campus closures.

Ed Department spokesperson Liz Hill said in a statement at the time that the decision to close was "highly disappointing and not best for its students," adding that "[i]nstead of taking the next few months to close in an orderly fashion, ECA took the easy way out and left 19,000 students scrambling to find a way to finish" their programs.

ECA's shutdown followed mounting problems that culminated when the Accrediting Council for Independent Colleges and Schools pulled accreditation Dec. 4 for some ECA campuses over concerns around "student progress, outcomes, student satisfaction, certification and licensure, and staff turnover."

Now thousands of students are left to try to finish their programs elsewhere or get their money back from the Ed Department. The situation mirrors the dramatic closures of other for-profits including Corinthian Colleges — which ended classes for 16,000 students "overnight" — and ITT Technical Institute, which also threw tens of thousands of students into educational limbo.

In these and other cases, recovering lost funds was a long, contentious process for students. In November, former ITT students won $600 million in loan forgiveness from a court after previously being hounded by debt collectors for repayments on funds they allege the for-profit characterized as grants. Former Corinthian students have also sued to cancel their debt.

Separately, after a court battle the Ed Department said Thursday that it was cancelling $150 million in student loan debt under Obama-era borrower defense regulations for those who attended colleges that closed between Nov. 1, 2013, and Dec. 4, 2015. The department said it has identified 15,000 eligible borrowers, of which about half attended Corinthian Colleges.

Students have been struggling to obtain debt forgiveness from Education Secretary Betsy DeVos' department. As of September, The Associated Press found the department had only granted full loan forgiveness to about 1,000 of roughly 16,000 fraud claims, while it denied more than 9,000 claims. Partial relief accounted for about 31% of those approved cases. Those who've been granted partial relief have had about 30% of their outstanding loans covered on average.