Earlier this month, Grand Canyon University, a Christian institution headquartered in Arizona with a large online footprint, lost a legal battle it was waging against the U.S. Department of Education.

A few years earlier, the Education Department determined that it would consider the university a for-profit college for federal financial aid purposes — even though it had nonprofit standing with the IRS. In its decision, the agency cited a Grand Canyon University services contract that gave a sizable portion of the institution’s revenue to its former owner.

Education Department regulations say that no part of a college’s net earnings may benefit any private shareholder or individual if it is to be considered a nonprofit. Grand Canyon University didn’t fit the bill, the agency decided.

Because of the department’s move, Grand Canyon University must follow a stricter set of regulations than nonprofits do.

Grand Canyon University asked the courts to reverse the Education Department’s decision, but a judge ruled that the agency has the power to determine whether a college is a nonprofit or for-profit. The case has major implications for the higher education sector, as Grand Canyon University is one of many for-profit colleges that have sought to convert to nonprofit status in recent years.

“It’s a really important ruling,” said Beth Stein, senior adviser at The Institute for College Access and Success, a group promoting accountability and equity in higher education. “It so clearly upholds ED’s authority to look closely at these transactions and to make determinations.”

For years, lawmakers and policy advocates have flagged some of these nonprofit conversions, pointing out deals they say allow for-profit colleges to evade the stricter regulations governing their sector even though their operations still financially benefit insiders.

A 2021 report from the U.S. Government Accountability Office, an auditing agency for Congress, backed up their concerns. It analyzed nearly five dozen nonprofit college conversions between January 2011 and August 2020. In about one-third of the deals, the nonprofit colleges still had relationships with their former for-profit owners or other officials who could influence their financial decisions.

But the landscape may be changing for nonprofit conversions. Part of that is because Grand Canyon’s legal loss may squash other colleges' desire to follow its playbook. But it’s also because the Education Department released new regulations that take effect in July that will tighten oversight of these deals and change how the agency defines nonprofits.

“There will be more scrutiny of these types of very questionable conversions going forward,” Stein said.

‘You have to have a clean transaction’

The GAO report pointed out different types of deals that were potentially problematic. One is when a college is sold to a nonprofit entity in a transaction that leaves it owing debt to its previous for-profit owners, especially when the purchase involves intangible assets. That’s because the value on paper of intangible assets — which include intellectual property and brand recognition — can easily be inflated to financially benefit the prior owners during a sale.

“It was far too easy for a former owner to write an IOU, where the nonprofit would pay over time, essentially building in the anticipated profit that they hoped would exist under the for-profit arrangement,” said Robert Shireman, senior fellow at The Century Foundation. “It was pretty clearly a scheme to make a for-profit appear to be nonprofit.”

Rep. Bobby Scott, a Democrat from Virginia, flagged Everglades College as one example of this type of deal. In early 2021, he urged the Education Department to reconsider the school’s nonprofit status.

In a letter, Scott wrote that the nonprofit Everglades College purchased the for-profit Keiser University in 2011. Under the deal, Everglades gave a $300 million IOU to its former owners as part of a roughly $521 purchase price based on an indepedent appraisal, according to the letter. But four years later, Everglades’ financial statement showed a much lower valuation for Keiser.

Jeffrey Laliberte, a spokesperson for Keiser, said in an email Friday that Scott’s letter contains many “inaccuracies and misleading statements.” For one, he said that an “independent valuation” said Keiser was worth more than $600 million.

The university's value was never significantly lower than the $600 million figure, he said. The value of the business remained high even though goodwill — an intangible asset — was reduced because of "non-profit reporting requirements," Laliberte said.

The new regulations address some of the concerns around Keiser and other colleges. They state that the Education Department is unlikely to approve a nonprofit conversion if the college owes debts to its former owner.

“It means you have to have a clean transaction,” said Michael Goldstein, managing director at Tyton Partners, an education consulting and investment banking firm. “The term that’s frequently used is a public company sale — where you’re selling a public company, you’re selling all of the stock of the company, you’re out of it, you get a check, you’re gone.”

These changes could have huge implications for the higher education sector.

That’s because it’s “extraordinarily common” for buyers to finance some portion of their purchases during all kinds of mergers and acquisitions, said Aaron Lacey, chair of law firm Thompson Coburn’s higher education practice. The firm in part focuses on postsecondary deals.

“It’s going to have an impact on how we structure these transactions,” he said.

Lacey gave the example of a recent nonprofit client he had that was considering acquiring a for-profit. The firm ensured it structured the deal so that no debt was owed after the sale, he said. He also voiced concerns that the Education Department’s approach to approving transactions was adding time and uncertainty around how the department will apply its policies — potentially killing off all types of deals.

However, Lacey said there is still interest in colleges acquiring for-profit colleges, including from private nonprofits with significant capital that see acquisitions as a way to fuel their growth.

An end to the Grand Canyon model?

Policy advocates have also pointed to another type of nonprofit conversion that involves ongoing contracts with a college’s former owner. It’s the type Grand Canyon University attempted.

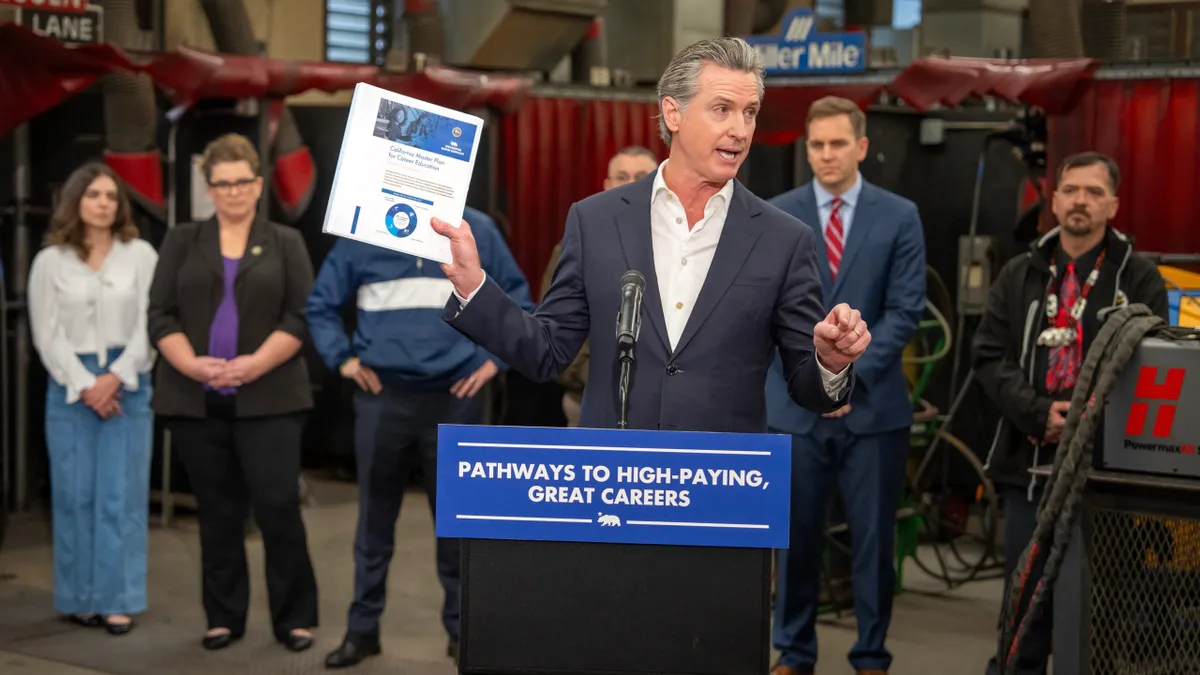

In 2018, it split from publicly traded for-profit Grand Canyon Education but agreed to pay the company 60% of its adjusted gross revenue in exchange for support services, such as marketing.

Although the spun-off university sought to become a nonprofit under the deal, the Education Department determined in late 2019 that the services contract was primarily intended to “drive shareholder value,” for the company. In an 18-page letter explaining the decision, the department also called the university the company’s “captive client.”

Grand Canyon University has pushed back on this label. Bob Romantic, a spokesperson for the university, said in an email Friday that this characterization is “completely false.” Romantic also said the university is “thriving both financially and academically” since it gained nonprofit status with the IRS, adding that the institution has $534 million in cash reserves.

Although Grand Canyon University provides Grand Canyon Education with the large majority of its business, the company also counts around two dozen other colleges as clients. Romantic said the company plans to add more in the future.

However, the Education Department’s new regulations could prevent other colleges from going Grand Canyon’s attempted route. They say the agency is unlikely to approve a nonprofit conversion for a college that has an ongoing revenue-share agreement with its former owner if that agreement is inconsistent with fair market value for the services it receives.

Some policy experts suspect that colleges have already lost their appetite for these types of arrangements.

“I know they’ve been arguing over it in court, but those of us who were paying attention decided five years ago that that kind of model was likely going to be a problem,” Lacey said.

But others are concerned that the new regulation carves out loopholes for college officials that want to pursue these deals.

The Century Foundation made that point in August in a public comment on the Education Department’s proposal for the new rule, arguing that the rule still could allow revenue-share agreements between a nonprofit and its former owners.

“We would have preferred for the department to go a bit further there,” Shireman said.

However, he added, the department has been conducting good reviews of these types of deals in recent years.

“We worry about a different administration making different choices,” Shireman said. “But the language in the final rule is pretty clear that they consider it to be these rare circumstances when there might be an ongoing relationship.”