Dive Brief:

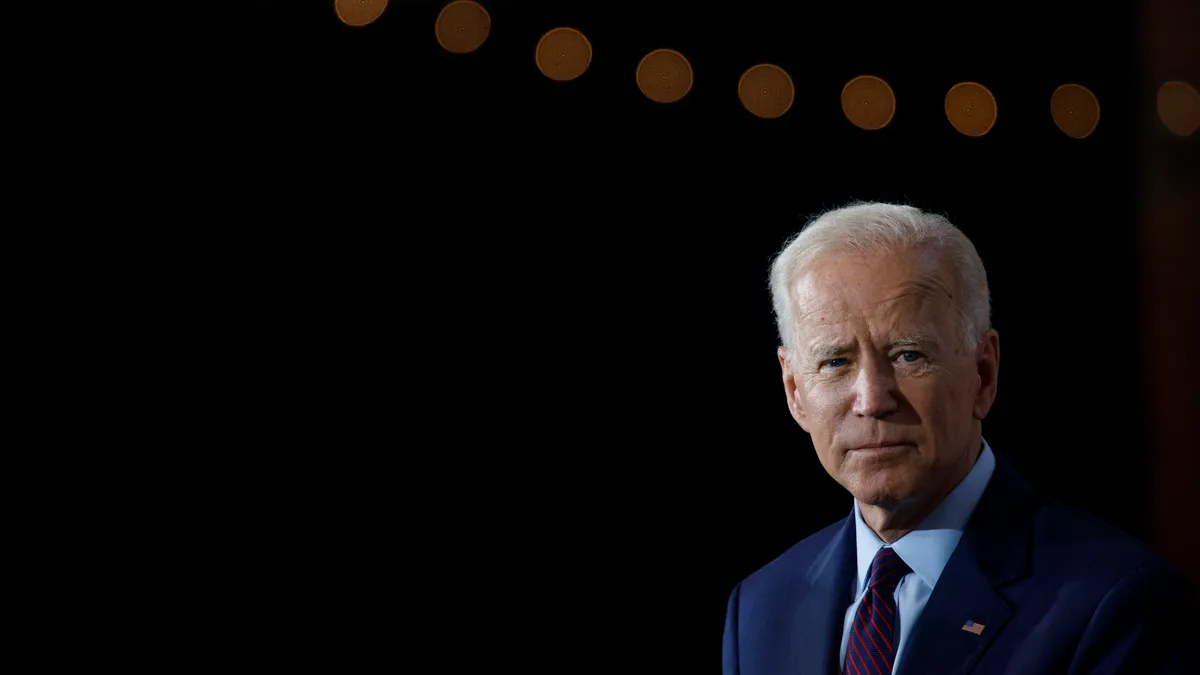

- The Biden administration pleaded with the U.S. Supreme Court on Wednesday to allow cancellation of mass amounts of student loan debt, arguing officials have executive authority to do so.

- In a court filing late Wednesday, lawyers for the Education and Justice departments said a group of six Republican-controlled states have no standing to sue over President Joe Biden’s student loan forgiveness plan, which would wipe away $10,000 in debt for borrowers earning up to $125,000, and $20,000 for those who received federal Pell Grants in college.

- Those states — Arkansas, Iowa, Kansas, Missouri, Nebraska and South Carolina — argued in a lawsuit last year that the White House lacks the power to greenlight broad loan forgiveness and that doing so would rob some of them of future tax revenue.

Dive Insight:

Progressives applauded Biden in August when he announced the most sweeping loan cancellation program in U.S. history.

Their excitement dimmed quickly, however, when the plan was caught up in a flood of lawsuits, some of which have notched wins in lower courts.

Those court rulings have since ground the student loan forgiveness plan to a halt. Two cases now sit before the Supreme Court to decide whether it can go forward — the Republican-led states’ lawsuit and one from two college graduates who claim the Biden administration arbitrarily excluded some borrowers from relief and didn't follow proper regulatory procedures.

Biden officials are arguing the coronavirus pandemic justified the debt cancellation program, as a 2003 law, the HEROES Act, allows the education secretary to unilaterally change the federal student loan system in times of national crisis or war.

The administration’s lawyers reiterated this point in the court brief filed Wednesday, writing that the “plan falls squarely within the plain text of the HEROES Act.”

A “central purpose of the statute is to authorize the Secretary to grant student-loan-related relief to at-risk borrowers because of a national emergency — precisely what the Secretary did here,” lawyers wrote.

They also took aim at the Republican states’ standing to sue.

When an appeals court temporarily blocked loan forgiveness in November, it homed in on potential harm to the Missouri Higher Education Loan Authority, a federal loan servicer.

However, the Biden administration contended in its court filing that any possible damages to the entity are speculative, noting it is separate from the state of Missouri. They also allege the states that fear a decline in tax revenue only have the structure of their own tax laws to blame.

Similarly, the two college graduates don’t have authority to challenge the program, the lawyers wrote. That’s because those who challenge policy before federal courts must prove their “injury would likely be redressed” if they succeeded in their lawsuits.

And the two graduates’ financial situation would be unchanged, or even worse off, if the loan forgiveness plan were to move forward, the administration said.

Stephen Vladeck, a constitutional law expert at the University of Texas Law School, agreed with the administration that the states and college graduates lack standing to sue.

However, the high court will likely want to decide on the merits of the case, not whether there is an issue of standing, he said in a phone call with reporters Wednesday night.

Past cases would suggest the lawsuits should be thrown out, but the Supreme Court “has not always been a model of consistency,” Vladeck said.

Oral arguments for the cases are scheduled for late February. The U.S. Department of Education has also extended a pandemic-era pause on student loan repayment because the loan forgiveness plan is on hold.

The moratorium will now continue until 60 days after litigation resolves or 60 days after the end of June — whichever comes first.

Education Secretary Miguel Cardona said in a statement Wednesday that officials “remain confident in our legal authority to adopt this program that will ensure the financial harms caused by the pandemic don’t drive borrowers into delinquency and default.”