Dive Brief:

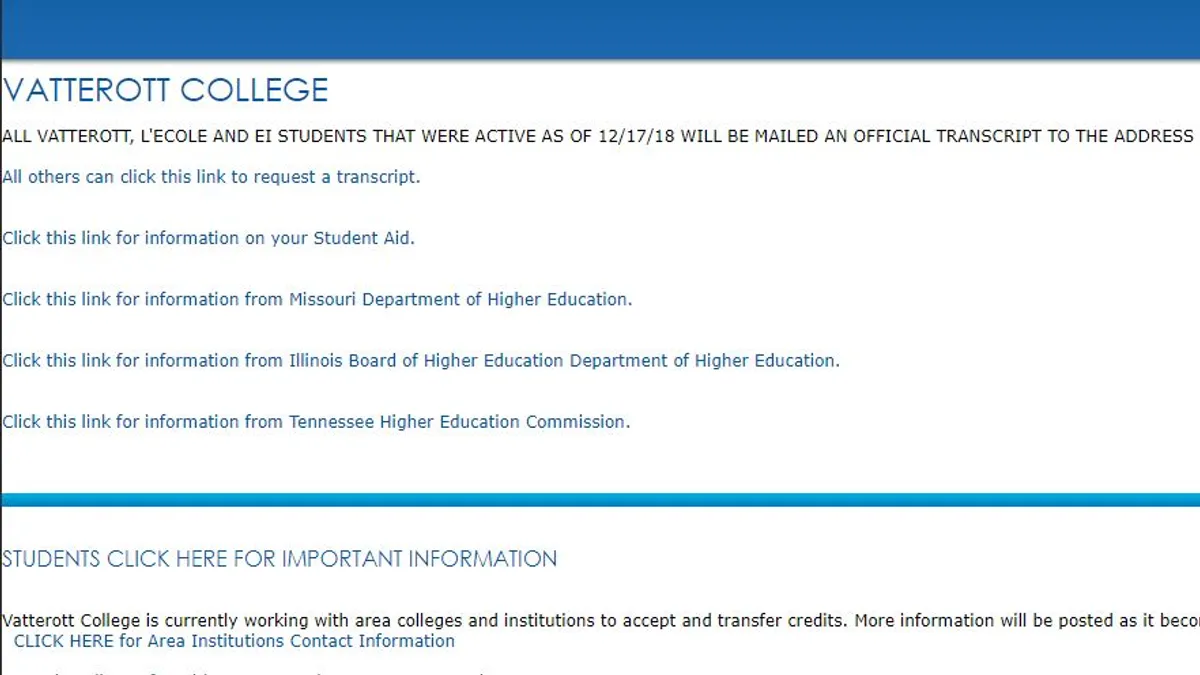

- Vatterott Educational Centers became the latest for-profit to shutter, and suddenly, with the company closing its 15 campuses this week. Vatterott said on its website it would mail transcripts to all students active as of its close date. The company said it was working with other schools on transfers, and as of Thursday it had posted 14 letters from trade, liberal arts and other colleges reaching out to displaced students.

- In a Dec. 17 letter to students, the Missouri-based Vatterott said "economic and regulatory conditions in recent years have had a significant, prolonged, negative impact" on its campuses and ability to raise financing or capital. Vatterott — which was formed in 1969 and largely specializes in professional and trade programs — said it was closing all campuses, effective immediately. The closure was so sudden it left some students with belongings locked in buildings, according to local news reports.

- Vatterott earlier this year entered Missouri state receivership and landed a buyer that would help it "stabilize and flourish," but new restrictions the Education Department placed on Vatterott's ability to provide federal financial aid made it unable to operate and complete the deal, the company said in the letter.

Dive Insight:

Vatterott's abrupt shutdown follows a troubling pattern among some for-profits, one of sudden closure that leaves thousands of students scrambling to find out what happened and what to do next. Some Vatterott students first learned of the closures by word of mouth, one local reporter wrote on Twitter.

The college did not name the buyer that it described as a possible savior in its letter to students. In January, however, Vatterott did announce a deal with Education Corporation of America (ECA) to buy select Vatterott campuses serving 90% of its student population. That deal apparently fell apart, and ECA, owner of Virginia College and Brightwood Career Institute, itself closed suddenly this month after its accreditation was suspended.

About two and a half years ago, Vatterott was on the other side of such an event, in that case welcoming former students of Wright Career College after the institution closed its doors and filed for bankruptcy. (Wright operated as a nonprofit after a conversion away from for-profit status in the 1990s, but The Century Foundation found evidence that leaders of the college profited from the institution.)

Vatterott noted in its letter to students that they may be able to apply for a closed-school loan discharge. In the case of ECA, the Ed Department has alerted some 20,000 students to transfer options and instructions for applying for a loan discharge.

In previous cases of for-profit closures, recovering lost funds came only after a long, contentious process for students. In November, former ITT students won $600 million in loan forgiveness from a court after previously being hounded by debt collectors for repayments on funds they allege the for-profit characterized as grants. Former Corinthian Colleges students have also sued to cancel their debt.

After a court battle, the Ed Department said earlier this month that it was cancelling $150 million in student loan debt under Obama-era borrower defense regulations for those who attended colleges that closed between Nov. 1, 2013, and Dec. 4, 2015. The department said it has identified 15,000 eligible borrowers, of which about half attended Corinthian.